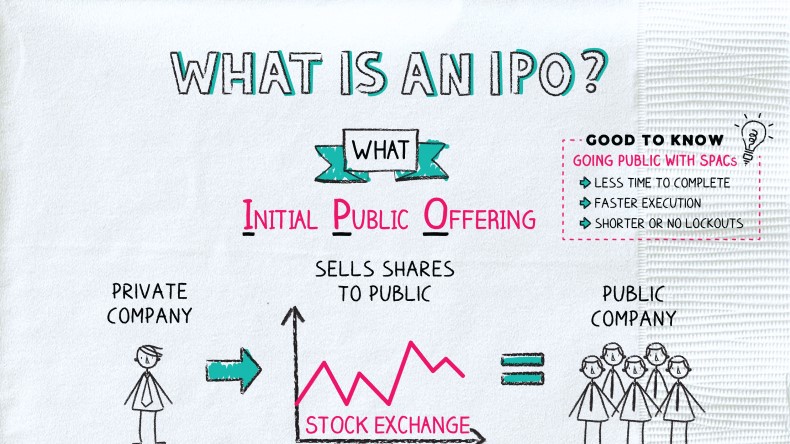

Initial Public Offering (IPO): What Is It?

Do you want to know the tricks of investing in a newly listed company? If yes, you should ensure that the scope of the errors is less from your end when you want to make the correct investment plans for a newly listed company.

Introduction To Initial Public Offering (IPO)

IPO of a new company can have some benefits as well as disadvantages. You must consider it all from your end while getting things done at a particular point in time. You need to get through the process while reaching your aims with ease.

IRFC share price keeps moving upwards and downwards, so before investing in new company share prices, you must consider specific facts to make the correct investment plans for your business.

Tips To Make Investments In Newly Listed Companies

There are several ways using which you can make investments in the IPO of a newly listed company. You must not make your choices incorrectly while easily reaching your aims. Some of the critical factors that you should take care of here are as follows:-

1. Check The Performance Of The Company

Before you invest in the IPO of a company, you must check the past performances of the company to ensure that the chances of your growth rate are higher. Do not make your selection on the wrong end.

You can make the comparison between the mass market paperback vs paper back to get insight into how you can cross-check the reputation of the company before you make your investment in the IPO of that company.

If the revenue of the company is growing by 20% annually, then it clearly indicates that the company is growing well and it is safe to invest your money in the shares of that company. Do not make your selection in the wrong end.

2. Select A Company That Has Strong Brokers

You must consider the fact that strong brokers can bring quality companies to the public. Companies that have small brokerages can provide you with less profit at the time of making the investments.

You must conduct your own research before making investments in the IPO of the new company. It will help you make the correct decisions at a specific time. Try to keep things in proper order while getting better returns from your investments.

The chances of your ROI returns will increase while you make the investments in the shares of the right company. Ensure that the scope of returns is more to the company whose IPOs in which you are making the investments if your money.

3. Crosscheck The Background Of The Promoters

It is one of the most important factors that most promoters need to keep in mind while making investments in the IPO of a particular company. You must cross-check the background of the promoters of the company and the kind of experience they have.

It will help you to make the correct decisions within a specific period of time. Ensure that the scope of errors must be less, which can assist you in reaching your aims within a particular time frame.

Try to make the correct decisions when you want to develop your earning from the IPO investments. Ensure that you should get fair returns from your investments. Accurate and appropriate plans here form a crucial role.

4. Read Carefully About The Prospectus Of The Company

Before you start investing in the IPO of a newly listed company, you must cross-check the company’s past performance to ensure better returns from your investments. You must cross-check the prospectus of the company to have a better idea of it.

You must not make things too complicated from your end. It will help you to list the information and faith to make investments in the IPO of a particular company. You must know how much money can be raised from the IPO of a particular company.

Try to keep things in a proper way while you want to reach your aims with complete ease. Ensure that the scope of inaccuracies must be less than your counterpart.

5. Always Wait For Lock-In Period

The lock-in period of any company that is issuing an IPO in the market must have a lock-in Period between 3 months to 2 years. Now, if the underwriters or the shareholders of this company hold the stocks of this company still now then it is a growing company.

The Stocks of this company have the power to provide more returns from your investments. It can boost the chances of your returns from your end. Try to keep things in proper shape while reaching your goals.

Final Take Away

Hence, if you want to get better returns from a newly listed company, you must select the best IPO that can offer you the complete solution within a specific period. You must not make your selection on the wrong end while getting things done in perfect order.

You can share your experience with us when you want to get things right within a perfect point in time. You have to follow the process that can boost the chances of your earning within a particular financing year.

Before you start investing in the IPO of a newly listed company, you must cross-check the company’s past performance to ensure better returns from your investments. You should not make your selection in grey.